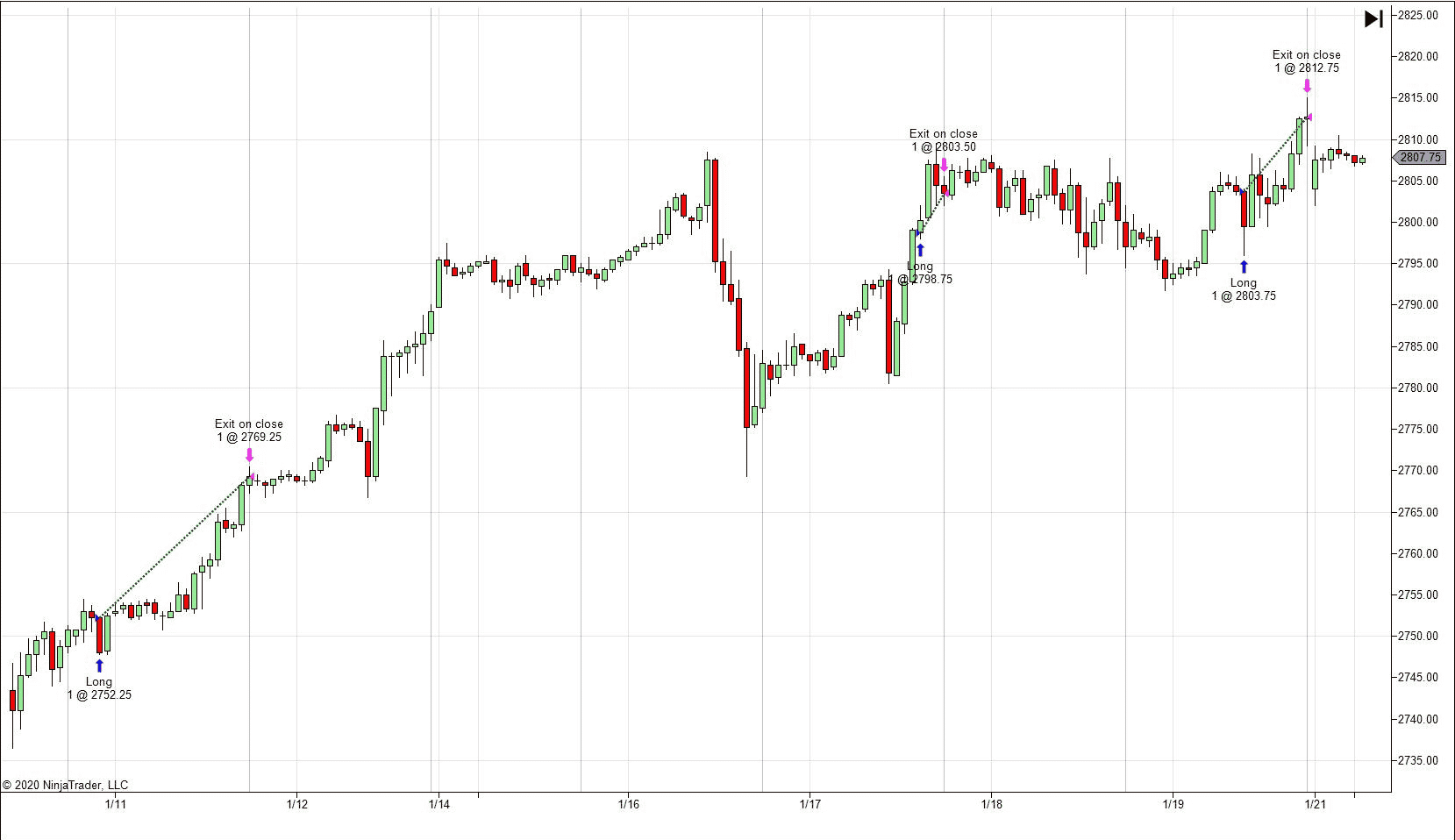

Lucrum Allegro Automated Trading System is a fully automated trading system for use on the S&P E-mini futures market. This system only trades at the most opportune times which coincides with acceptable risk:reward parameters. This means that the frequency of trades is about once per week. This system is best suited for diversifying additional investment methods and has a suggested minimum account balance of $10,000 USD.

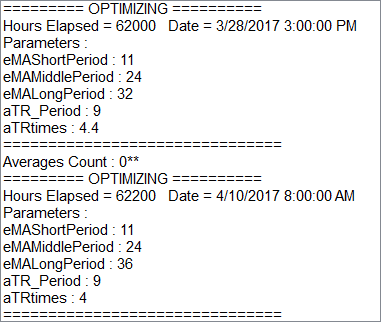

Lucrum Allegro is a unique system that has a built-in walk forward optimizer. This allows the system to optimize specific parameter ranges based on the previous sample size. This design has the intention of anticipating similar market conditions in the periods moving forward and capitalize on optimized settings.

Designed to have long bias, Allegro will only take long positions. A secondary system to adapt to accepting some short positions can be enabled which puts the weighting to be about 3:1 long to short trades. Activating the short ruleset is optional and may hedge against bearish markets.

Allegro has the option to operate with exiting any open trades at the session end or holding until other exit conditions are met.

For the latest backtested performance reports and information please contact us.

The built-in optimizer of the Allegro system takes several impactful parameters and adjusts them to optimal levels based on the previously designated period, by default this period is every 200 bars or 200 hours however this can be extended or reduced.

Parameter optimization ranges are limited to not exceed acceptable levels. This prevents excessive processing time as well as possible outliers in optimal ranges.

All optimization functions are handled behind the scenes and will automatically adjust as the system runs.

Disclaimer

Copyright 2024 @ Lucrum Trading Systems. All rights reserved. Privacy Policy